Featured Investor

PARK

AVENUE

PARTNERS

MHP Owners | Park Operators

Park Avenue Partners is a real estate investment partnership that invests in and operates mobile home parks nationwide. It is our mission both to generate above-average risk-adjusted returns for our limited partners, as well as to increase the supply of affordable housing for low-income Americans.

Park Avenue Partners is a real estate investment partnership that invests in and operates mobile home parks nationwide. It is our mission both to generate above-average risk-adjusted returns for our limited partners, as well as to increase the supply of affordable housing for low-income Americans.

We value transparency and alignment and with our investors. To that end, we charge neither management fees, nor acquisition fees, nor divestiture fees, nor personal guarantee fees, nor fees of any kind. Investors are always welcome to come on-site to ‘kick the tires’ with us and tour the properties we own together. We provide detailed quarterly reports on our operations and profitability. Our Limited Partners put up the equity capital, we arrange and often personally guarantee the debt capital, and operate the properties ourselves. We split profits as follows:

A Shares – 50%/50% split of all profits and depreciation

B Shares – 12% preferred rate of return, 10% of additional profits and depreciation

We view our unique no-fee business model as being the only way to truly partner with our investors to co-own properties together and make investment decisions that are in everyone’s best interest.

Invest:

We’d Love To Co-own Mobile Home Parks With You

If you want a quick ‘elevator pitch’ as to why you should consider investing with us, please click here for a one page summary.

If you’d like a more in-depth understanding of what we do, please join us at one of our dinners or webinars (schedule below) or watch a recorded webinar here.

If you are at the stage of more seriously considering investing with us, and you are an Accredited Investor, please download and read the Private Placement Memorandum (“PPM”) below. (Per SEC regulations, our fund is only open to Accredited Investors.) There are risks with all investments; this opportunity is no different. Please read the PPM in it’s entirety, including the four Exhibits, and ask any and all questions you have prior to investing.

Should you choose to invest, please click the ‘Click To Invest’ button below. Completing the online form takes around 20 minutes to input your personal and financial information and to digitally sign your Subscription Agreement. We will check your background to confirm you are an Accredited Investor, as well as perform an AML/KYC screen. The verification process takes three days. You may invest individually, or through a self-directed IRA, Trust, investment partnership, or other entity of your choosing.

If you have questions prior to investing we will be happy to answer them. Please join us at one of our dinners, or on an upcoming webinar, or feel free to email us and we’ll coordinate a time for us to talk one-on-one.

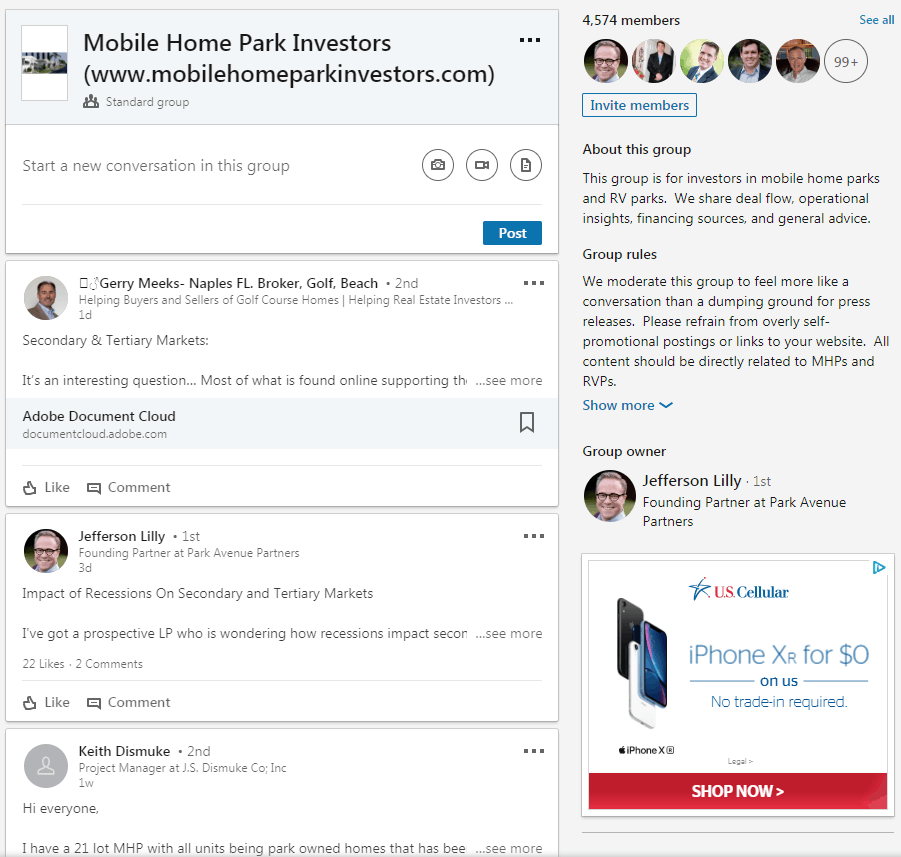

Join our LinkedIn Group!

Territories We Operate In:

- Nationwide

- Canada

- Europe

- Open To All Geographies

Investor Dinners:

Please email us if you would like to attend one of the following dinners. All attendees must be Accredited Investors. We will be announcing additional dinners coast-to-coast in February and March. Please sign up here to be notified.

MARCH

Orlando, FL – Monday, March 4th

Minneapolis, MN (TBD)

Seattle, WA (TBD)

London, England (TBD)

Tokyo, Japan (TBD)

Beijing, China (TBD)

Shanghai, China (TBD)

Webinars:

WEBINARS

Our live webinar schedule (all times PST):

Saturday, February 9th, 10 a.m.

Monday, February 11th, noon

Saturday, February 16th, 10 a.m.

Saturday, February 23rd, 10 a.m.

Monday, February 25th, 5 p.m. PST

Click here to join any of our webinars at the appointed time. There is no advance registration required. There is a GoToMeeting download, so please click to join a few minutes in advance.

Watch a recorded webinar here.

Late in February we will send out an announcement about the timing of webinars in March via our mailing list. Please sign up here to be notified.

The content covered on the webinars will be the same as what is covered in our investor dinners (investment thesis, track record, management philosophy, deal flow, etc.).

One on One:

We prefer to answer investor questions at our dinners and on our webinars if it works for your schedule. But if none of our dinners or webinars is convenient, please let us know, and we will arrange a webinar or meeting that is convenient.

Follow Park Avenue Partners

Tags

∙ Investing

∙ Manufactured Home Real Estate

∙ Podcasts

∙ Education/Teaching

Reviews

Without A doubt, Jefferson’s education and experience as a mobile home park operator shines forth in all of his podcast episodes. If a person has a strong interest in investing in the MHP space, or owning and MHP, I would highly recommend that extreme attention be given to listening to most, if not all, of the episodes.

comfortablefuture.com

iTunes

Love Jefferson's podcast on MHP. Learned a ton from this show. In the process of finishing all the episodes. Thank you, Jefferson, for putting together this fantastic show, full of very very useful!

VincentG

Stitcher

I have listened to hundreds of investing podcasts and this is one of the best so far. It is no secret that Jefferson is an expert in his field. I look forward to getting to know him and his partner Brad better through this podcast. The first few delivered solid content sans the fluff and upsell of many podcasts. Job well done men. Keep up the good work and I look forward to future episodes.

Dhdzhddjdhi

iTunes

I'm a newbie at this, and I've listened to all the podcast twice, some of them 3x or more. I've learned in my short life that there are only 2 teachers in life: Mentors or Mistakes, and I prefer the former over the latter! :)

Mike_T

Stitcher

I've been listening to podcasts for 4+ years now and I have yet to find any other real estate podcasts that bring such a high level of experts and knowledge as this podcast does. Kevin really knows his business well.

macjm007

iTunes

Investment Thesis:

We believe mobile home parks (aka ‘manufactured housing communities,’ ‘trailer parks,’ and ‘trailer courts’) to be the best real estate investment available today for the following reasons:

Competition is ‘illegal.’ Over the past 30-or-so years nearly every city and county government nationwide has outlawed construction of new mobile home parks. Governments have changed zoning to be ‘apartment only’ multi-family, or have changed density such that only single-family housing may be built. This growing ‘NIMBY’ attitude (Not In My Back Yard) among government leaders is the result of we believe unfounded bad publicity of mobile home parks, and the fact that as (mostly) unimproved land, mobile home parks can not be taxed as highly as apartment buildings and traditional residential dwellings and do not generate as significant a tax base as traditional real estate.

Tenant turnover is much lower than in traditional multi-family properties. Residents of apartment communities move out approximately every 2 years (e.g. 50% annual tenant turnover). Residents in mobile homes parks tend to own their mobile homes. They show pride of ownership, and if and when the time comes to move, they usually sell their home to a new resident rather than pay $4,000 – $8,000 to move it. This means as long as the mobile home is cared for, someone will be paying rent on it until it ‘end-of-lifes.’ We estimate mobile homes to have a 50-year useful life, which means turnover should be around 2% annually, perhaps a bit higher due to a few move-outs. Lower turnover means lower vacancy and lower marketing and move-in/out costs.

Finally, an additional implication of tenants owning their homes is reduced Repair & Maintenance for landlords. By virtue of owning their mobile homes, residents own the proverbial ‘leaky toilets and leaky roofs.’ Frankly neither roofs nor toilets leak as much when a responsible tenant owns their dwelling and cares for it as an owner. Landlords are left with Repair & Maintenance costs primarily for the land (mowing, paving, tree trimming, plumbing). We estimate R&M expenses for a mobile home park landlord to be 60% – 75% less than comparable costs for apartment landlords.

Real Money Television Interview

Featured In:

Jefferson is a mobile home park investment expert and educator. He is responsible for Park Avenue Partners’ strategic direction, acquisitions, and property operations. Prior to founding Park Avenue Partners, he co-founded Park Street Partners, a similar partnership also focussed on acquiring mobile home parks nationwide. PSP’s investments are returning 8% – 15% cash annually to Limited Partners; appreciation is expected to increase returns further.

Both personally and through his partnerships, Jefferson has acquired 25 MHPs in 13 states since 2007 totaling over $56mm in value. He started the industry’s first podcast and the largest group on LinkedIn dedicated to investing in mobile home parks. Prior to beginning to manage investors’ money in 2014, Jefferson spent seven years investing his own capital in mobile home parks and consulting to high-net-worth families with interests in the manufactured housing industry. Earlier in his career he held a range of consulting and sales positions with Bain & Company, Viacom, and Verisign. Jefferson has been featured in The New York Times, Bloomberg Magazine, and on the Real Money television show. He holds a B.A. from the University of Pennsylvania and an MBA from the Wharton School of Business.

Jefferson’s favorite mobile home is the 1954 Spartan Imperial Mansion, upon which our logo is partially based. He finds the Bowlus Road Chief to be pretty appealing too.